U.S. Tops Windstorm Damage Claims

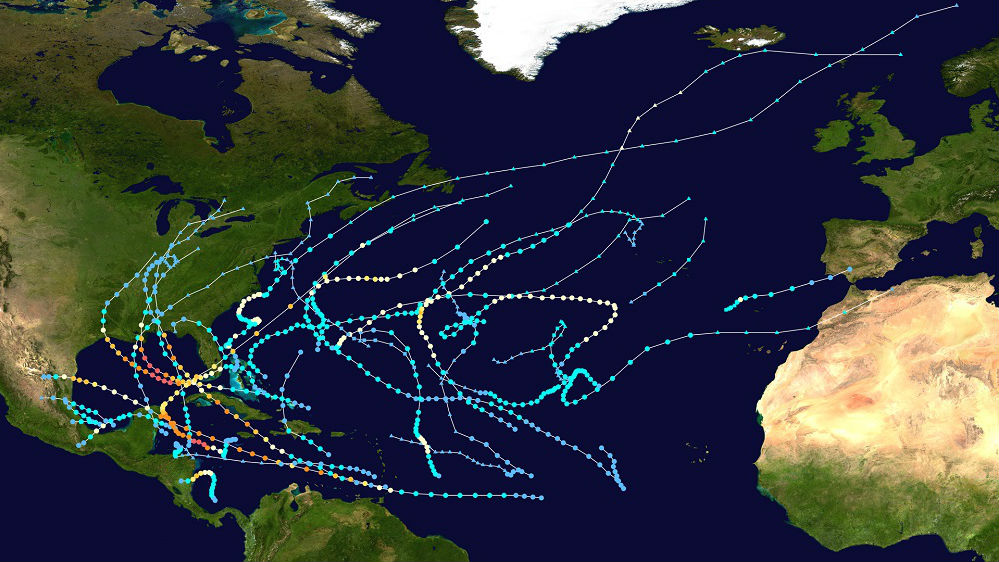

2005 Atlantic Hurricane Season

2005 Atlantic Hurricane Season By Wendy Laursen 2015-08-18 17:24:23

The U.S. is the top location in the world for windstorm related insurance claims, says insurer Alliance Global Corporate & Specialty, and there are lessons to be learnt for shipowners from the largest one, Hurricane Katrina, 10 years on.

To mark the 10-year anniversary of Hurricane Katrina, Allianz Global Corporate & Specialty (AGCS) has released a report Hurricane Katrina 10: Catastrophe Management And Global Windstorm Peril Review. The report analyzes windstorm risks and losses and examines the business lessons learned from Katrina for future global windstorm loss mitigation, given increasing weather volatility.

Hurricane Katrina, which struck the Gulf Coast on August 29, 2005, remains the largest-ever windstorm loss. Four thousand lives were lost during the 2005 hurricane season, 80 percent of the city of New Orleans flooded, $125 billion in overall damages and 1.7 million insurance claims filed.

“Katrina will always be remembered as an extraordinary natural disaster that affected millions of individuals and businesses and left an indelible impact on the global insurance industry,” says Hugh Burgess, head of corporate lines of AGCS. “Even without considering the influence of climate change, the prospect of increasing losses due to storms is more of a result of continued economic development in hazard-prone developed coastal areas. Preparedness limits windstorm exposure and Katrina has taught us many lessons on this front.”

“Katrina will always be remembered as an extraordinary natural disaster that affected millions of individuals and businesses and left an indelible impact on the global insurance industry,” says Hugh Burgess, head of corporate lines of AGCS. “Even without considering the influence of climate change, the prospect of increasing losses due to storms is more of a result of continued economic development in hazard-prone developed coastal areas. Preparedness limits windstorm exposure and Katrina has taught us many lessons on this front.” Forty percent of natural hazard claims windstorm-related

Whether it is hurricanes in the U.S., typhoons in Asia or winter storms in Europe, windstorm ranks fifth in the top 10 causes of loss for business according to value of claims, according to an AGCS analysis of more than 11,000 AGCS major business insurance claims worldwide from 2009 to 2013. Windstorm losses account for approximately 40 percent of all natural hazard losses by number of claims and 26 percent by value.

The U.S. is the top loss location, accounting for half (49 percent) of the global claims analyzed, followed by Europe (19 percent), Asia (nine percent) and Central America (three percent). Growth of exposure is far outpacing take-up of insurance coverage resulting in a growing gap in natural catastrophe preparedness.

Marine sector accounts for majority of windstorm claims

Claims analysis reveals the maritime industry accounts for 60 percent of windstorms claims analyzed by number compared with 30 percent for property. Destruction of high-value pleasure craft, commercial vessels and cargo can significantly increase the loss tab.

“Claims can also be incurred due to water ingress into ships damaging the cargo,” says Captain Andrew Kinsey, Senior Marine Risk Consultant, AGCS. “Storms can also damage or destroy ports or coastal infrastructure, including warehouses and stored cargo, cranes, quaysides, terminals, buoys and sheds.”

Shipowners at Risk

Kinsey says shipowners need to understand the fact that ships are safest at sea; that is the environment that they are designed for. Diligent weather tracking and optimal route planning are critical during storm seasons. The effects of a major storm can have long lasting impacts on the infrastructure of a port.

Are the channels navigable, or has shoaling occurred? Are the terminals, pilots, tugs and other support services back up and operating to receive cargo?

“An often overlooked aspect of the infrastructure puzzle is if the follow on pieces of the supply chain are ready to handle and deliver the cargo to its final destination. Major storms do not just affect the waterborne aspect of transportation; road and rail systems are also impacted,” says Kinsey.

“An often overlooked aspect of the infrastructure puzzle is if the follow on pieces of the supply chain are ready to handle and deliver the cargo to its final destination. Major storms do not just affect the waterborne aspect of transportation; road and rail systems are also impacted,” says Kinsey. “At AGCS we advise shipowners of the importance of having a “Plan B” for handling their cargo and keeping their vessels on schedule. Contingency planning is critical, and it should not just be a binder that is kept on the shelf. It should be a plan that is regularly reviewed and the parties included actively involved in.”

Lessons learned from Katrina

Storm Surge - Katrina and other storms such as Sandy have helped to greatly improve catastrophe risk research and modeling. Katrina showed the impact of storm surge can often be more damaging than high wind speeds and that the physical size of the hurricane can affect the surge itself. Storm surge has been a contributing factor in half of the top 10 costliest storm losses in U.S. history, with these five storms having collectively caused almost $125 billion in insured losses.

U.S. Levees - The flooding caused by Katrina also showed the state of the levee systems in the U.S. to be substandard and in need of repairs estimated to be $100 billion, according to the National Committee on Levee Safety. There are many levee systems throughout the U.S. that would reveal similar deficiencies if subjected to the same level of scrutiny as those in New Orleans.

Wind Damage - Most of the wind damage caused by Katrina occurred to the building envelope, comprising roof covering, walls and windows. After Katrina, Allianz developed enhanced roof surveys, placing greater scrutiny on condition and age of roofs.

Demand Surge - The aftermath of Katrina was marked by a surge in demand for building materials, resulting in rising prices and supply shortages. This can also have peripheral loss consequences, as were seen post-Katrina with the use of substandard, hazardous resources.

“Today, the Gulf Coast is better prepared to withstand the effects of a hurricane due to better education, improved construction guidelines and increased third party inspection,” says Thomas Varney, Regional Manager, North America, Allianz Risk Consulting.

Extreme weather risk mitigation

Based on Allianz’s analysis, the severity of losses from weather events, including windstorms, is increasing. The average amount paid for extreme weather events by insurers between 1980 and 1989 totaled $15 billion a year. Between 2010 and 2013, this rose to an average of $70 billion a year.

The report is available here.