The 911 calls began before midnight, with reports of downed power lines and exploding transformers. What would swiftly grow into the deadliest wildfires in California history were ablaze -- and fingers were soon pointing at PG&E Corp.

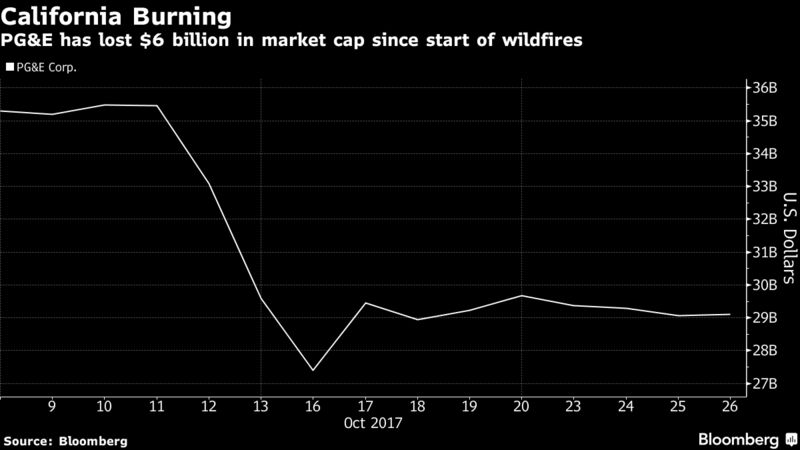

Investigators may never be able to determine what ignited the wine country fires, but PG&E, one of the nation’s largest utilities, is struggling to fend off catastrophe anyway. The mere suggestion its equipment might be to blame was enough to send shares tumbling, wiping out about $6 billion in value. The stock was trading at $57.06 Friday, down 17 percent since Oct. 9, the first trading day after the fires started.

Fire glows on a hillside in Napa, California on Oct. 9.

Photographer: Josh Edelson/AFP via Getty Images

Investors are spooked, said Deutsche Bank Securities Inc. analyst Jonathan Arnold. “Why would they continue providing capital to a private utility if that utility could be held liable for property damage in a major catastrophe regardless of finding of fault in their operations?”

And if PG&E is found to be directly at fault? Bad blood between the state and its largest power provider runs deep, with the utility cited in previous wildfires and still under review for a 2010 natural-gas pipeline explosion that killed eight people. One legislator has already demanded regulators disband it if its carelessness or neglect is discovered to be the culprit.

“The patience level of California is very low” with PG&E, said Shahriar Pourreza, a Guggenheim Securities analyst. “It’s not outside the realm of reason to see a situation where the utility is broken up, sold or taken private.”

Investors began dumping the San Francisco-based company’s stock on Oct. 12. The first lawsuit came five days later, filed by a Santa Rosa couple who lost their home and contend PG&E failed to maintain and inspect transmission lines.

‘Extreme Gusts’

The suit claims PG&E equipment “came in contact with vegetation and caused a wildfire,” without specifying when or where.The trigger is what the California Public Utilities Commission and the California Department of Forestry and Fire Prevention, known as Cal Fire, are probing. The PUC on Wednesday expanded to eight counties from three the scope of its directive that PG&E “preserve all evidence” in the fires’ paths, and increased the number of wildfires to 15 from seven.

Homes destroyed by wildfires in Santa Rosa on Oct. 12.

Photographer: David Paul Morris/Bloomberg

PG&E has said it won’t speculate about what set the multiple conflagrations off. “What caused them? The simple answer is we don’t know yet,” Chief Executive Officer Geisha Williams wrote in an op-ed for the San Francisco Chronicle. She did note, though, that there were “extreme gusts” of wind in Northern California and quoted a Cal Fire official who said winds contributed to the worst “fire event” in his 30-year career.

The company said Friday it was making some billing changes to help support fire victims, waiving deposits for those seeking to re-establish service and suspending collections.

The company was found guilty of criminal negligence in a 1994 blaze in the Sierra Nevada, for failing to trim trees near power lines. It was fined $8.3 million for not maintaining a line that sparked the Butte Fire in 2015, which killed two people; a judge in a lawsuit in that fire said the utility couldn’t escape responsibility for damages because of the inherent danger of transmitting electric power near trees, and it didn’t matter how much effort PG&E put into vegetation management.

But the disaster most damaging to PG&E’s reputation in California was no doubt the deadly pipeline explosion in San Bruno seven years ago. Regulators imposed fines of $1.6 billion, and PG&E was found guilty in federal court of safety violations. When the state was weighing an even larger $2.25 billion penalty, then-CEO Tony Earley warned that such a cost could push the company to the brink of bankruptcy.

Now with the wine country fires, Pourreza said, “they are facing a situation here that could turn out to be worse than San Bruno.”

==================

PG&E shares plunge on concern its power lines may have started California wildfires

The California Public Utilities Commission sent a letter on Thursday to PG&E reminding them to preserve "all evidence with respect to the Northern California wildfires in Napa, Sonoma and Solano Counties," according to multiple reports.

The commission was investigating whether electrical lines that were knocked down by a windstorm on Sunday played a role in sparking the most lethal wildfire event in the state's history.

October 2017 CNBC.com

Eric Risberg | AP

A Pacific Gas and Electric crew works at restoring power along the Old Redwood Highway Wednesday, Oct. 11, 2017, in Santa Rosa, Calif.

Shares of electric utility company PG&E plunged 7.7 percent Friday on concerns its power lines may have started the massive wildfires that have ravaged California recently.

The stock was also on track for its worst day since September 2010.

The California Public Utilities Commission sent a letter on Thursday to PG&E — California's largest electrical utility company — reminding them to preserve "all evidence with respect to the Northern California wildfires in Napa, Sonoma and Solano Counties," according to multiple reports.

The commission was investigating whether electrical lines that were knocked down by a windstorm on Sunday played a role in sparking the most lethal wildfire event in the state's history.

"Safety is our top priority," said Donald Cutler, a spokesperson for PG&E. "Our customers are our neighbors and friends and we're doing everything we can to help out."

Unfortunately, California has a history of power company lines becoming the sources of fires. It is still not clear if PG&E was to blame for the fires, but it has been found guilty before of negligence in fires.

Past fires where PG&E was faulted include the deadly Butte Fire in California's Amador County in 2015. Cal Fire investigated the fire, which destroyed 549 homes, and ended up sending a bill to PG&E for about $90 million to cover firefighting expenses.

In 2007, the Malibu fires that burned more than a dozen structures were caused by Southern California Edison utility poles that fell during heavy winds; they paid $63.5 million in fines. Also, San Diego Gas & Electric power lines started three major fires the same year and paid nearly $700 million to insurers to settle claims.

PG&E shares are down 13 percent this week.

The drop in the stock "reflects the following assumptions: 1) the fire was caused by PCG's negligence, 2) insurance coverage for 3rd party liabilities will be very limited, 3) damage costs per acre far larger than those for the 2015 Butte fire and 4) material fines and penalties will be assessed," Christopher Turnure, an analyst at JPMorgan, said in a note Thursday. "We appreciate the severity of the fires and the legal challenges of operating in California, but estimate this loss of value as approaching a worst-case scenario for PCG shares."

PCG is the stock ticker for PG&E.

Turnure is maintaining his overweight rating on the stock on the notion these fears are overblown.

The wildfire has killed at least 31 people in Northern California and has left hundreds missing in the heart of wine country. The toll from the more than 20 fires raging across eight counties could climb, with more than 400 people in Sonoma County alone still listed as missing.