Design Professional Perspective: Waivers of Subrogation

What are they, and why should I care?

When an insurance company pays for a loss, and someone other than its insured might be to blame, the insurance company can sue those responsible to recover the financial losses it paid on the insured’s behalf. The subrogation means that the insurance company is stepping into the shoes of its insured, and suing the responsible parties as if it were the insured filing suit directly.

When insurance companies start suing to get money back, this often results in cross-claims among parties and fights over who did what wrong.While subrogation disputes during construction are less common, they can not only sour relationships among design and construction team members and owners, but they can also be expensive.This type of litigation can slow the progress of construction, complicating the project or causing the owner to terminate its relationship with the design professional.

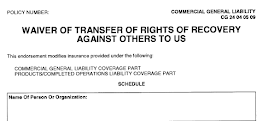

Instead, parties can agree up front in their contracts that if there is a loss, and the loss is paid by insurance, the insurance company cannot pursue recovery through the process of subrogation from any party. This contractual mechanism is referred to as a waiver of subrogation; as a result, the insurer’s rights are effectively waived by the policyholder.

When not properly addressed a waiver of subrogation provision can create a headache for a design firm. To learn how to avoid, XL Catlin’s Design Professional’s newest white paper – Waivers of Subrogation: What are they and why should I care? — explains the key distinctions of these provisions, why design firms should have one and how they work in the construction world.