Unhappy homeowners pack crumbling foundations meeting

Updated: 9:21 am, Mon Jul 25, 2016.

By Anthony Branciforte

SOUTH WINDSOR, CT — Residents of South Windsor and the surrounding area on Thursday expressed their frustration, desperation, and disappointment that the state cannot force insurance or concrete companies to help them with crumbling foundations.

Attorney General George Jepsen said last week the state has no legal authority to compel insurance companies or J.J. Mottes Co., the Stafford concrete company at the center of the ongoing crumbling foundations problem, to aid residents.

He was in attendance at Thursday night’s meeting of the Connecticut Coalition Against Crumbling Basements, a group formed to address the widespread problem of crumbling foundations throughout the state.

Jespsen told the group of affected homeowners who packed South Windsor’s council chambers there is no basis to file a successful claim and that it would be unethical for him to pursue a case he did not believe his office could win.

“We have to be able to prove things in court,” Jepsen said. “Anecdotal evidence isn’t enough.”

Deputy Attorney General Perry Zinn-Rowthorn reconfirmed that pyrrhotite, a mineral found in the concrete poured by J.J. Mottes, is likely to blame for the crumbling foundations.

“Preliminary conclusions are that pyrrhotite is the common denominator in these foundation failures,” he said.

However, this is also the reason legal action by the state is not an option.

“To this day, nowhere in the United States is there a building standard, a regulation, a statute that limits how much pyrrhotite” can be in concrete, Zinn-Rowthorn said.

In May, the J.J. Mottes voluntarily agreed to not sell aggregate from Becker's Quarry for use in the installation of residential concrete foundations. The attorney general’s office also recommended the Connecticut General Assembly consider enacting a standard restricting pyrrhotite in concrete.

Jepsen said Insurance Commissioner Katharine Wade is in the preliminary stages of obtaining information about private settlements between homeowners and insurance companies concerning this issue.

However, given the apparently devastating financial consequences of the failing foundations throughout South Windsor and several other towns, the main focus of the coalition is to provide financial relief to homeowners.

The plan that has been fielded in the past several weeks is to establish a program in which insurance companies in the state would provide a combined $52 million in funds for repairs. So far, only Travelers and The Hartford have stepped forward.

“One of the things we’re telling everybody, public officials and citizens, is that insurance companies ought to be hearing from the people urging them to participate in a program,” Zinn-Rowthorn said.

However, even if the fund were established, residents would need to submit an application before insurance companies would send someone to evaluate their concrete. If skeptical, the company would then test the pyrrhotite levels in the concrete before eligibility for funds was established.

Zinn-Rowthorn said “concern and uncertainty about how many homes are affected” is a serious issue.

Given that many of the affected homes will be uninhabitable in six months to a year, these answers garnered some pushback from Mayor Thomas Delnicki and Sen. Timothy Larson, D-East Hartford.

“I think the insurance companies need to step up to the plate,” Delnicki said. “A lot of pressure needs to be put on them. I believe the banks have a huge part in this as well.”

While Delnicki emphasized that more people need to come forward and pressure their insurance companies, Larson said more people would come forward if a solution were already established.

“You folks are looking for a remedy, and I think it’s incumbent upon us to make sure that we can formulate some sort of strategy that allows you to come forward and get your properties fixed,” Larson said. “The banks have not been at the table, and part of the consternation of you not coming forward is the minute you identify your house is delinquent and the bank steps in on this because they have to, it could be just cataclysmic for people.

Larson garnered loud applause after finishing his remarks.

While many homeowners expressed appreciation for the Town of South Windsor’s efforts on the issue in comparison with other affected towns, they, too, were unsatisfied with the options presented.

South Windsor resident Brian McAndrew, 51, delivered his public comments while holding back tears.

“Personally, it’s financially devastating to me,” he said, noting that he is putting two children through college. “To suggest that an individual approach their insurance company personally is a bit perplexing to me.”

While the insurance commissioner has guaranteed that homeowners with crumbling foundations cannot be legally dropped from their policies for that reason, McAndrew was still concerned.

“There are a lot of ways not to renew someone other than a foundation that’s not covered,” he said. “My fear would be if I expose myself to that insurance company suddenly they’re going to look for something that could cause me not to be renewed. That susceptibility scares the hell out of me.”

A married couple who requested anonymity expressed similar concerns.

“The big discussion is how many people are affected,” the husband said. “Well, it was a week ago Monday that my wife and I found out.”

He said that they planned to sell their home — which has been paid off for 10 years — and use the money to move to North Carolina. They are now unable to sell their home and will soon be unable to live in it.

“It will cost more to fix that house than it’s worth,” said the wife. “We put our heart and soul into that house. It’s worth nothing and we can’t fix it because we don’t have the financial means.”

She also said the state allowed several insurance companies to rewrite their policies to exclude concrete coverage after these issues came to light.

“Waiting until you have all the numbers and all the money isn’t going to help the people in this room, nor is it going to help me,” said a Tolland resident who only found out within the past week that she is among the affected homeowners.

Homeowner Jim Williams lamented the political structure that he believes perpetuates these problems.

“Who’s running the state — is it the insurance companies or the government?” he asked. “You make me pay insurance, and when I have the biggest problem of my life, the insurance company is not there. I feel like a high school hockey team playing against the Stanley Cup champions. Someone has to step up and fight these people.”

===========================

Ed. Note: The original version of this story incorrectly referred to John Patton as the president of the J.J. Mottes company. He is, in fact, a spokesperson.

Basement walls are crumbling across a section of eastern Connecticut and few seem to know why.

The issue has plagued some homeowners for nearly 20 years.

According to contractors and building officials from South Windsor to Willington, the only fix is for the foundation walls to be removed and re-poured. In each known case, insurance companies immediately deny the coverage claim.

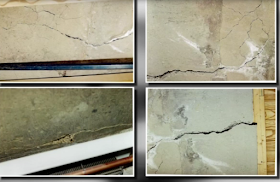

Donald Childree, a general contractor from South Windsor, says he’s been in up to 75 different homes with the issue. He says it begins with hairline horizontal cracks, often more than 15 years after the foundation is originally placed. In time, map cracking develops, with some cracks big enough to fit a hand in.

"You’re looking at a minimum of $125,000 upwards to $200-250,000," Childree said, of the cost to replace the foundations. "Insurance companies absolutely will not cover anything."

Dozens of affected homeowners, contractors and building officials claim all of the failed foundations were poured between the early 1980s through 1998 by J.J. Mottes Company, a concrete and septic supplier out of Stafford Springs.

Dean Soucy is a general contractor out of Tolland. He says he’s received a "call or two per week" over the last several years from homeowners with the same issue.

He says each foundation he’s seen with the similar, distinct cracking was poured by J.J. Mottes Company in the '80s or '90s.

"This is like an epidemic as far as the housing industry is concerned," said Soucy, as he brought the NBC Connecticut Troubleshooters through the basement of an affected home in Ellington.

Joseph Callahan, chief building official in Coventry, says all of the issues he’s seen in his 26 years of working in Coventry and Manchester were from J.J. Mottes concrete.

"I’ve never encountered anybody who had a foundation failure with anyone else’s concrete," said Callahan.

Towns don’t require permits for concrete foundations, but dozens of affected homeowners say it was J.J. Mottes Company who poured their concrete.

According to its website, J.J. Mottes Company was created in 1947.

In a statement, J.J. Mottes Company spokesperson John Patton did not comment on any issues prior to 1998, the year he purchased the company from in-laws.

His statement reads:

"The current ownership of the Joseph J. Mottes Company has been in place for 15 years. During this time, it has produced ready mix concrete for approximately 10,000 different residential, commercial, municipal and state jobs. We are aware of no project, not one, that has had the recently discovered phenomenon of pyrrhotite reaction and we have not been notified by either state regulators or industry sources of this alleged problem.

"We produce our concrete using sand, water, granite stone, Type I/II cement and standard industrial admixtures and use the exact same materials for our residential, commercial, and government work - the latter two of which are rigorously tested and inspected prior to and during installation. We have and continue to meet all of the standards of our industry and the regulations of the State of Connecticut.

"There are many factors that go into producing a good concrete product. Quality concrete mix handled improperly in the installation process or installed in unfavorable site conditions can result in a poor quality foundation.

"We have begun working with our managers, geologists and testing labs to review our manufacturing methods and materials to eliminate even the slightest possibility of this problem occurring with our Ready-Mix concrete. We are confident that the products we are producing today will continue to meet the needs of the surrounding region."

The statement does not address the alleged issues of foundations poured from the early 1980s to 1998, and contractors say the issues often take longer than 15 years for the concrete to show signs of failure.

What’s causing the issue has mystified homeowners, contractors and the state for close to 20 years, but Donald Childree believes he has the answer. He says an iron sulfide mineral called pyrrhotite is to blame.

Research suggests the effects of pyrrhotite in stone used as concrete aggregate could be catastrophic. Over time, water and air oxidize the pyrrhotite, creating a chemical reaction. This causes the concrete to swell and expand, leading to the cracking, and eventually raising the home from the foundation.

In one region of Quebec, Canada, the government set up an emergency fund to pay for hundreds of homes with crumbling basements affected by pyrrhotite in the concrete.

pyrrhotite is pretty rare in Connecticut, but according the U.S. Geological Survey, it is found in Willington at Becker’s Quarry. Becker’s Quarry is owned by the family that owns J.J. Mottes Company. The company confirmed the quarry is where J.J. Mottes has obtained stone used in their concrete aggregate for decades.

Sources confirm pyrrhotite was found in testing on some foundations consisting of J.J. Mottes-poured concrete. Court records reference reports describing an iron sulfide chemical reaction creating the foundation failures.

We cannot determine whether or not the mineral was present in all the failed basement walls because most were not tested, and settlements of litigation with their insurers prevent homeowners from disclosing the findings.

Linda Tofolowsky, formerly of Tolland, says she was the first homeowner to notice the intense cracks on her basement walls, a little over 10 years after they moved into a home on Kent Road South in 1985. She says her insurance company denied her claim. Tofolowsky says she tried to seek help from the town and the state, and eventually the courts.

The Tofolowskys took J.J. Mottes Company to court, alleging claims for product liability. In 2003, the company was found not liable for installing faulty concrete based on strength testing and a finding that the problems with the foundation were caused by the installer rather than a defect in concrete.

However, we found no record that the concrete from the Tofolowskys' home was tested for pyrrhotite. The court also found the Tofolowskys' claim fell outside the 10-year statute of limitations.

Walter Zaldwy built his home in 1988 in Willington. He says J.J. Mottes supplied the concrete for his foundation. He never questioned why his insurance company sent him a notice in 2008 stating his foundation would no longer be covered – until he started noticing the spider cracks on his walls growing within the last year.

"Looking back, I’m wondering, how did they get this information to decide they weren’t covering basement foundations anymore?" Zaldwy said.

Zaldwy now must decide if he can afford to pay the hefty cost of replacing the foundation or just walk away from his biggest investment.

"I spent a good part of my life trying to work and to achieve the American dream by owning the home to have it fall out from underneath me," he said.

There is some hope for homeowners. While still denying claims, insurance companies are starting to settle with some homeowners, but it often only after a long legal battle.