The

car ferry Norman Atlantic is pictured on the way to Brindisi harbour

after it caught fire in waters off Greece December 29, 2014 in this

handout photo provided by Marina Militare via Reuters

To show this, global marine insurance provider Allianz Global Corporate & Specialty (AGCS) has released its third annual Safety and Shipping Review 2015, which analyzes reported shipping losses of over 100 gross tons.

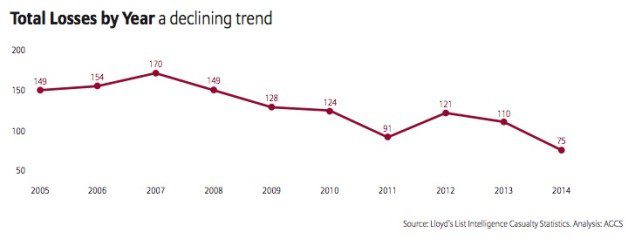

Among other findings, the study showed that in 2014 the maritime industry continued to improve its safety record, with the number of total losses reported worldwide reaching its lowest level in 10 years.

In 2014, year-on-year total losses – defined as actual total losses or constructive total losses recorded for vessels of 100 gross tons or over – fell by 32% to 75, well below the 10-year loss average of 127. Since 2005 shipping losses have declined by 50%.

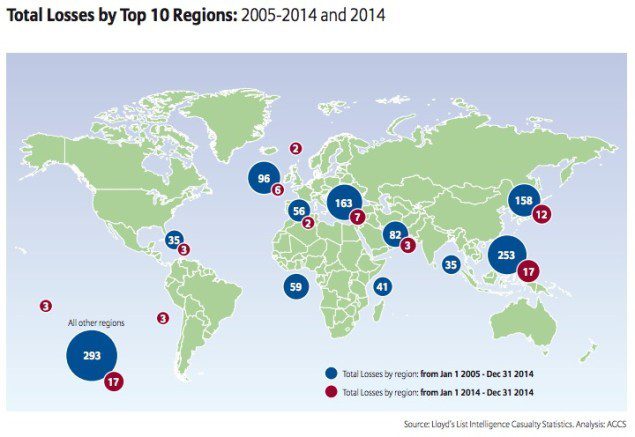

The report found that South China and South East Asian waters were hotspots for losses. More than a third of 2014’s total losses were concentrated in the two maritime regions: South China, Indo China, Indonesia & Philippines with 17 losses, followed by Japan, Korea and North China with 12.

According to the report, there were 2,773 shipping incidents (casualties) globally, including total losses, during 2014. The East Mediterranean & Black Sea region was the top hotspot with 490, up 5% year-on-year, although only 2% of those (7) were considered total losses. The British Isles, North Sea, English Channel and Bay of Biscay ranked second with 465, up 29%. Over the past decade, the latter region ranks as the top for incidents.

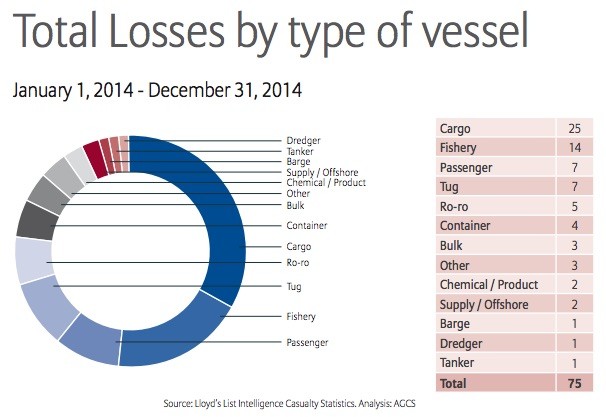

When talking maritime losses and casualties, the type of vessel has shown to play a significant role over the years. In 2014, a third of the vessels lost were cargo ships (25), while fishing vessel was the only other type of vessel to record double digit losses (14). Together, cargo ships and fishing vessels accounted for over 50% of all losses in 2014.

Looking at the 1,271 total losses recorded since 2005, cargo ships (523) and fishing vessels (229) have accounted for almost 60% of them.

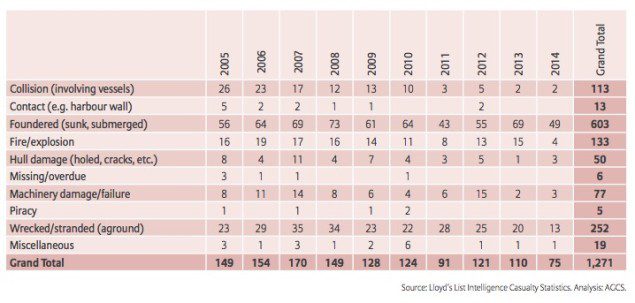

According to the study, foundering continued to be the number one cause of losses in 2014, with 49 vessels foundered. This represents 65% of all losses in 2014, although the number of foundering losses was down almost 30% year-on-year yet above the 10-year average of 47%. Wrecked/stranded was the second top cause of losses on 1014 with 13. Of note, 2014 saw a significant reduction in the number of fires/explosions (4), compared to 15 in 2013.

In the past decade, December has proven to be the worst month for losses in the Northern Hemisphere (110) with a 64% increase compared with the quietest month – May. In the Southern Hemisphere it is August (22) with a 214% increase in losses compared with December. For every total loss in the Southern Hemisphere there are approximately 7 in the Northern Hemisphere.

It’s Not All Good News

While the overall decline of total losses may seem encouraging, the AGCS report notes that recent casualties such as Sewol disaster in South Korea and Norman Atlantic fire in the Mediterranean have once again raised significant concerns over training and emergency preparedness aboard passenger ships three years after the Costa Concordia disaster. In 2014, passenger ships accounted for almost 10% of total losses, with 7 ships lost.

“In many cases construction of the vessel is not the only weak point. These two incidents underline a worrying gap in crew training when it comes to emergency operations on ro-ro ferries or passenger ships,” says Sven Gerhard, Global Product Leader Hull & Marine Liabilities, AGCS.

The AGCS reported noted other areas of concern, such as the rapidly increasing size of containership and floating offshore facilities.

“Larger ships can also mean larger losses. The industry should prepare for a loss exceeding $1 billion in future featuring a container vessel or even a specialized floating offshore facility,” Gerhard said.

For these so-called “mega-ships”, AGCS has identified a number of risks including including the fact operation is limited to a small number of deep water ports, meaning an increased concentration of risk. Other risk factors associated with these larger ships include a shortage qualified seaman and the complexity of salvage and removal, as was the case with the wreck removal of the Costa Concordia.

“The shipping industry should think long and hard before making the leap to the next ship size,” adds Captain Rahul Khanna, Global Head of Marine Risk Consulting, AGCS.

In addition to size, AGCS has also found that cyber risks represent another new threat for the shipping industry.

A cyber-attack targeting technology on board, in particular electronic navigation systems, could possibly lead to a total loss or even involve several vessels from one company,” said Gerhard. Other scenarios include cyber criminals targeting a major port, closing terminals, or interfering with containers or confidential data, according to AGCS. Of course these insurers are trying to scare the shippers so that they buy insurance from them. Then, they are refusing coverage when a loss occurs.

Another area of risk mentioned in the report is increased ship traffic in the Arctic and Antarctic. The shipping industry recently welcomed the arrival of the long-awaited Polar Code, a number of questions still remain, particularly particularly around crew training, vessel suitability and potential clean-up.

“The Polar Code will need constant revision, the AGCS report says. “Any shipping problems encountered and best practices to employ should be outlined at the end of each season.”

Other risks identified in the 2015 Safety & Shipping Review include:

- Over-reliance on electronic navigation: The

collision of the cargo ship Rickmers Dubai with an unmanned crane barge

in 2014 is an example of the perils of overreliance on

e-navigation. Training standards around systems such as Electronic Chart Display and Information System (ECDIS) are mixed. “Officers need robust training in order to avoid misinterpretation of ECDIS and operating mistakes that could lead to expensive disasters. Beyond that manual navigation aids and skills are still crucial,” says Khanna.

- Rise in geopolitical uncertainty: The recent rise in geo-political tension around the world is concerning. The increase in human trafficking of refugees by sea creates search and rescue issues. More than 207,000 migrants crossed the Mediterranean in 2014, driven by the civil war in Syria. The International Maritime Organization estimates at least 600 merchant ships were diverted in 2014 to rescue people, stretching resources and rescue infrastructure. Conflicts in the Middle East also put increasing pressure on the supply chain. Ships should not underestimate the security risks.

- Piracy risks move from Africa to Asia: Although there has been good progress tackling activity in Somalia and the Gulf of Guinea, ensuring global attacks (245) are down for a fourth year in a row, piracy thrives elsewhere. Attacks in South East Asian waters are up year-on-year, as are incidents in the Indian subcontinent, with Bangladesh a new hotspot.

All photos/graphics are courtesy AGCS unless otherwise stated